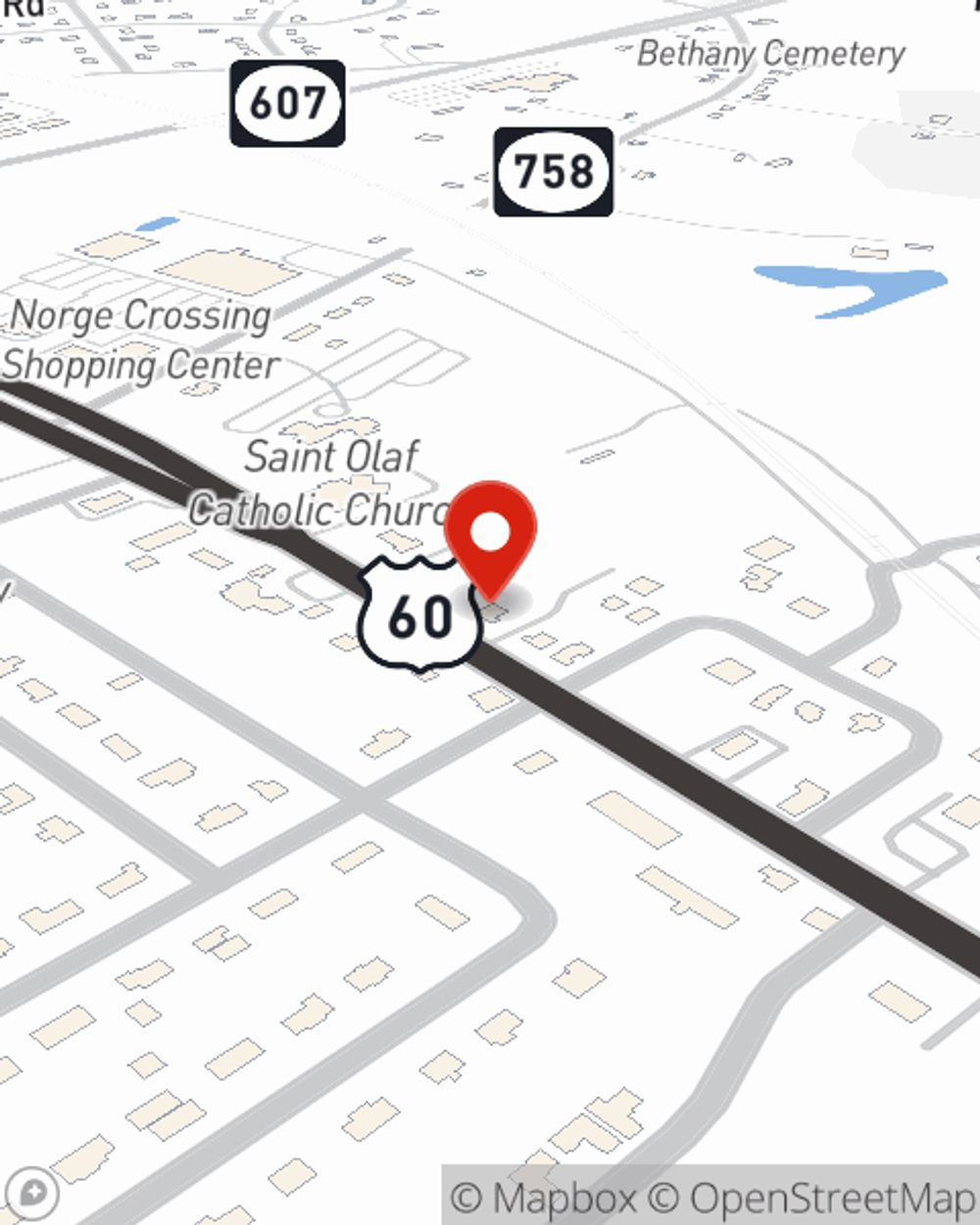

Business Insurance in and around Williamsburg

One of the top small business insurance companies in Williamsburg, and beyond.

Cover all the bases for your small business

This Coverage Is Worth It.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Brock Dehlin. Brock Dehlin gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Williamsburg, and beyond.

Cover all the bases for your small business

Surprisingly Great Insurance

Whether you are a florist a psychologist, or you own a janitorial service, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Brock Dehlin can help you discover coverage that's right for you and your business. Your business policy can cover things such as money and business liability.

Reach out to the wonderful team at agent Brock Dehlin's office to learn more about the options that may be right for you and your small business.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Brock Dehlin

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.